Would you buy groceries, without knowing its price until after you cook dinner? Strangely, the healthcare industry expects this out of any patient. It is quite stressful to read and understand the inclusions and exclusions of any health insurance policy. However, missing these clauses in the document can only lead to you holding a big fat bill at the end of the treatment, only a portion of which is covered by your insurance.

1. Pre-existing medical conditions - It could be a cancer diagnosis before policy purchase. If the cause for your current medical condition/treatment is found to be diabetes, cholesterol or hypertension, then you will have to pay out of your own pocket.

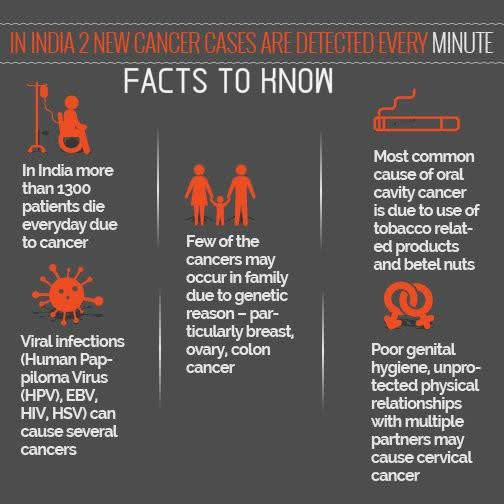

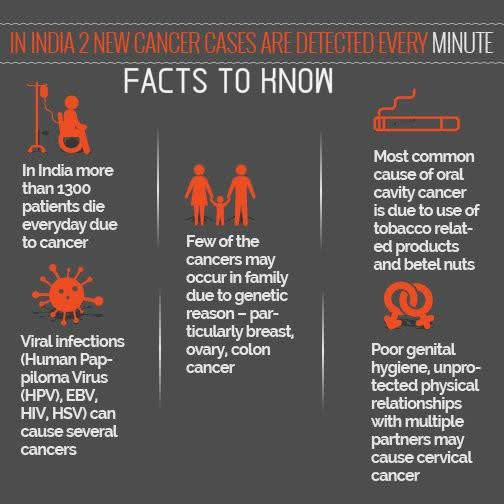

Image Source: My Insurance Bazaar

Lifestyle-induced disease - Needless to say, you cannot claim insurance for any disease that results from alcohol/smoking/drug abuse. Interestingly, some insurers investigate cause to validate the claim.

Consumables and Non-medical - The IRDA has created a list of non-medical items that are non-payable including but not limited to shampoo, powder, slippers, bedpan, sterile gown and even bandages. Click here for a list of these non-payable items.

Psychiatric or psychosomatic disorders - Treatment would not require hospitalization. The current scope of health insurance in India cannot really cover for it. However, the IRDA issued a circular in August 2018 asking insurers to cover mental illness on par with physical illness.

"This just means there will be no discrimination. When it comes to claims, the situation remains the same. Even a mental illness can be caused by alcohol or drug abuse. So several claims can be denied on these grounds," said the claims manager who requested not to be named due to the sensitive nature of his job.

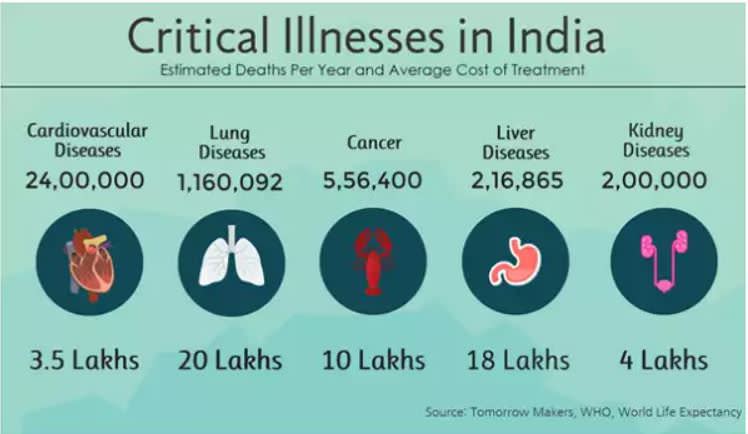

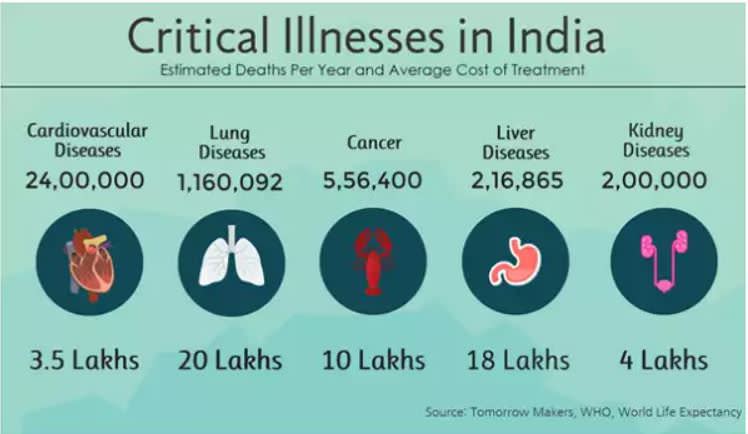

Image Source: Economic Times

Treatment outside India - Years ago, people traveled abroad looking for a cure for their rare medical condition. Now, even after India has become a hotspot for medical tourism, high-net-worth individuals continue to travel overseas for treatment as they can afford it and lack faith in the Indian healthcare system. As a result, all but three insurers (Cigna TTK, Max Bupa and Religare Health Insurance) have a blanket exclusion on treatment overseas. The three insurers target this segment useful for those who can pay a higher premium and get past the waiting period to avail treatment coverage for a limited number of medical conditions.

Congenital problems - Any congenital anomaly like a hole in the heart, cleft lip, missing limb, metabolic disorders or blocked ducts that may lead to chronic illnesses, are excluded. It is frustrating for new parents who are already under duress when they realize that their newborn's surgery or ICU stay cannot be reimbursed by their insurer.

Artificial life-maintenance - If a family is unwilling to say goodbye to a loved one, and clings to the hope that a medical miracle would restore their health, they might have to pay the bill from their own pocket. The IRDA includes this under permanent exclusions in the document defining policy terms for Max Bupa Health Companion Plan, for instances "where such treatment will not result in recovery or restoration of the previous state of health"

Image source: HealthAnalytics

Share your experience or more information on insurance exclusions with us at content@milaap.org.

____________________________________________________________________________________

Other sources of good information on this topic:

https://economictimes.indiatimes.com/wealth/insure/what-your-health-insurance-policy-will-not-cover/articleshow/65267561.cms

https://timesofindia.indiatimes.com/life-style/health-fitness/health-news/80-of-Indian-population-not-covered-under-any-health-insurance/articleshow/51952542.cms

https://www.livemint.com/Money/Degw7xq8PHo8xQU7LKIJ3M/best-health-insurance-policy-health-insurance-premium.html

https://economictimes.indiatimes.com/industry/banking/finance/insure/diseases-after-health-policy-purchase-should-be-covered-irdai-panel/articleshow/66519347.cms

https://www.thehindubusinessline.com/money-and-banking/irdai-panel-suggests-excluding-17-ailments-from-medical-cover/article25419243.ece

What are some permanent exclusions?

The Insurance Regulatory and Development Authority Of India (IRDAI) lists a few permanent exclusions from all plans including sexually transmitted diseases (STDs), dental treatment, birth control/fertility-related procedures, hormone replacement therapy, intentional self-injury, and war injuries. Treatments relating to these will not be covered by your insurer, ever.What about a waiting period?

No treatment will be covered for the first 30 days after purchase of a policy, except accidental injury. Some medical diseases and conditions are excluded from your cover for a waiting period of 2-4 years.For example, if you purchased an ICICI or Max Bupa health policy in 2019, you have to continuously renew your policy for 2 years, after which your dialysis for renal failure will be covered. Exceptions are made in case you are involved in an accident and need emergency treatment.

What you may not know about the list of temporary exclusions

The list of temporary exclusions is fairly common across various health insurance plans.1. Pre-existing medical conditions - It could be a cancer diagnosis before policy purchase. If the cause for your current medical condition/treatment is found to be diabetes, cholesterol or hypertension, then you will have to pay out of your own pocket.

A medical-finance coordinator is currently helping end-stage liver disease patients find various ways of financing says, "Cirrhosis caused by Non-alcoholic Fatty Liver Disease may run in families. So if your mother or grandmother has it, it is possible for you to develop as well. Not many people are even aware of it when they have cholesterol or fatty liver. Failing to declare this history, can affect your claim." She requested not to be named so she could share her views candidly. "Liver disease is almost always hereditary or congenital, causes that are excluded by almost all insurers. In 500 cases I have seen, only 3 have managed to get complete coverage for their liver transplants. The treatment is expensive, and the best plan is to buy a policy with the highest premium," she adds.

Image Source: My Insurance Bazaar

Lifestyle-induced disease - Needless to say, you cannot claim insurance for any disease that results from alcohol/smoking/drug abuse. Interestingly, some insurers investigate cause to validate the claim.

“Sometimes, claims are repudiated on the grounds that the ailment was caused by alcohol abuse or smoking. If you do not agree, you can raise a dispute. The causation has to be established for such rejections,” says A.S. Narayanan CEO, McXtra, a health insurance servicing start-up in an interview with Economic Times. Commenting on this, a claims manager at a Bangalore-based health insurance based company revealed, "When such disputes are raised, the team combs through the patient's life, as far as scouring social media to support our case. Suppose you are in a photo with a drink in your hand, it serves as proof. When you buy a policy, you agree to the rules and drinking even a glass of wine would mean breaking that rule."

Consumables and Non-medical - The IRDA has created a list of non-medical items that are non-payable including but not limited to shampoo, powder, slippers, bedpan, sterile gown and even bandages. Click here for a list of these non-payable items.

Psychiatric or psychosomatic disorders - Treatment would not require hospitalization. The current scope of health insurance in India cannot really cover for it. However, the IRDA issued a circular in August 2018 asking insurers to cover mental illness on par with physical illness.

"This just means there will be no discrimination. When it comes to claims, the situation remains the same. Even a mental illness can be caused by alcohol or drug abuse. So several claims can be denied on these grounds," said the claims manager who requested not to be named due to the sensitive nature of his job.

Image Source: Economic Times

Treatment outside India - Years ago, people traveled abroad looking for a cure for their rare medical condition. Now, even after India has become a hotspot for medical tourism, high-net-worth individuals continue to travel overseas for treatment as they can afford it and lack faith in the Indian healthcare system. As a result, all but three insurers (Cigna TTK, Max Bupa and Religare Health Insurance) have a blanket exclusion on treatment overseas. The three insurers target this segment useful for those who can pay a higher premium and get past the waiting period to avail treatment coverage for a limited number of medical conditions.

Congenital problems - Any congenital anomaly like a hole in the heart, cleft lip, missing limb, metabolic disorders or blocked ducts that may lead to chronic illnesses, are excluded. It is frustrating for new parents who are already under duress when they realize that their newborn's surgery or ICU stay cannot be reimbursed by their insurer.

Artificial life-maintenance - If a family is unwilling to say goodbye to a loved one, and clings to the hope that a medical miracle would restore their health, they might have to pay the bill from their own pocket. The IRDA includes this under permanent exclusions in the document defining policy terms for Max Bupa Health Companion Plan, for instances "where such treatment will not result in recovery or restoration of the previous state of health"

Is there a plan that can cover all my needs?

Yes and no. Insurance providers offer a top-up plan, that you can add to your current policy at an extra premium for wider coverage. However, these plans can be costly sometimes and may not be able to be purchased for all treatments. For example, a top-up plan can include ambulance charges, maternity benefits, donor expenses in case of organ transplants, non-allopathic treatment, and certain preexisting conditions if they are not congenital.Any comprehensive health plan or even a group medical policy covers only for hospitalization.

Image source: HealthAnalytics

What do I do if I have no insurance?

Would you ride a bike without a helmet on and hope something else braces impact when you fall? No. Insurance is your helmet. It will save you from a mountain of pain. If the claim amount is inadequate or your claim is denied based on exclusions, then you can look at other options including:- Government schemes

- NGOs and Foundations that are striving to make health care accessible to all by creating a corpus fund

- Crowdfunding campaigns that have helped raise crores for major surgeries where people across the world donate to save lives.

- Low-interest or 0% interest loans which could come handy while facing a mountain of bills

Share your experience or more information on insurance exclusions with us at content@milaap.org.

____________________________________________________________________________________

Other sources of good information on this topic:

https://economictimes.indiatimes.com/wealth/insure/what-your-health-insurance-policy-will-not-cover/articleshow/65267561.cms

https://timesofindia.indiatimes.com/life-style/health-fitness/health-news/80-of-Indian-population-not-covered-under-any-health-insurance/articleshow/51952542.cms

https://www.livemint.com/Money/Degw7xq8PHo8xQU7LKIJ3M/best-health-insurance-policy-health-insurance-premium.html

https://economictimes.indiatimes.com/industry/banking/finance/insure/diseases-after-health-policy-purchase-should-be-covered-irdai-panel/articleshow/66519347.cms

https://www.thehindubusinessline.com/money-and-banking/irdai-panel-suggests-excluding-17-ailments-from-medical-cover/article25419243.ece